Transition To Omni-Channel Direct Sales

Type: Blogpost

Posted on

In a previous article (“Making the transition from online to true ecommerce”), we looked at a hypothetical OEM that had moved to omni-channel direct sales. We discussed customer behaviour, online tools, pricing, and the need for the retail agency model.

Now let us take a look in more detail about some of the changes accompanying omni-channel direct sales and what it might mean for the OEMs and their networks.

Today

In the current franchise model, the OEM has a tool kit for selling its products as demand and supply wax and wane. Obviously, they make plans for each area and measure sales closely. At a high level, they move production between markets, within the constraints of market specifics like which side of the car has the steering wheel.

Within markets, OEMs advertise campaigns for specific models. They provide funds to allow their network to discount certain models, to drive demand. The industry has a cycle of pushing demand at month, quarter and year ends and I think most consumers know this.

OEMs have Sales Field Teams who work with the network on targets for the year. Then, during the year, their job is to work with their retailers to make it happen.

If the OEM shifts additional volume into a market, then these levers are used to sell that volume.

Omni-channel Direct Sales

In a future model of omni-channel direct sales, responsibilities and levers change. It is likely to lead to new retail formats and different structures within the networks.

Responsibilities and Levers

The OEM will now be responsible for the price of retail products. Do not forget that this is not new because this situation exists for most fleet sales in the UK. Fleet Agency has been around for 20 years or so. Under these models, the retailer has a ‘contract to sell’ instead of a ‘contract to buy’ and receives fees for PDI, handover and so on.

The OEM will have agreements with its Fleet customers covering price, volume discounts, service levels and so on. The OEM can introduce special offers to stimulate demand where sales need a boost, or a batch of cars needs shifting.

The OEM might have a couple of thousand fleet customers so their offers can be customer targeted. For Retail Agency, an OEM will have a new direct contractual relationship with tens of thousands of customers which means the initial phase will be focussed on ‘market’. They will use their enquiry and sales data to set national prices and tweak them as required.

In time, they will migrate to a more personalised service in line with what is normal in the online world.

Retail Formats

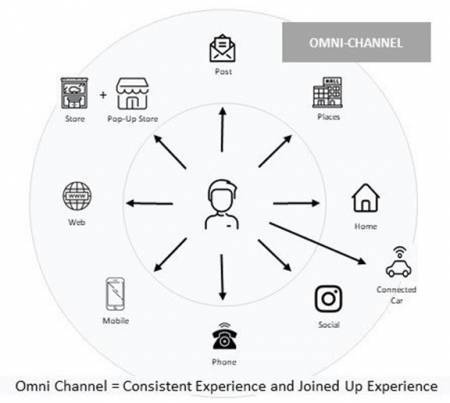

Omni-channel refers to a seamless customer journey through numerous channels shown in the diagram below. It’s a bit more than just ‘bricks and clicks’.

The principle of price being owned by the OEM means that more physical retail formats can be used. Again, nothing to invent here either. Most OEMs, in conjunction with their networks, have tried formats such as:

- Stores in shopping malls, for example, SEAT at Lakeside and White City.

- Stores within stores, for example, Ford and Next.

- Pop Up shops, for example, Mercedes-Benz.

- Digital or ‘cyber’ stores such as the Audi City concept.

- Experience Centres such as Porsche as Silverstone and Mercedes-Benz World.

These are the formats chosen, in the main, by new entrants such as Tesla. As we know, they had a properly joined up online and physical presence from the start. But industry suppliers, such as Rockar are making that happen now for the OEMs too.

What it Means for the OEM:

Business to Consumer

Few OEMs sell direct to the consumer (B2C) now, except, of course, the new entrants. However, a few now sell digital services direct to consumers, online, that allow upgrades the specification of the car. For example, BMW’s Connected Drive and Audi’s Functions on Demand.

The OEM finance operations work B2C but only as part of the retailer’s sales process. They are best placed to understand and push renewals and they know what equity is in the car as the loan is paid down. It means that the OEM has to decide how the National Sales Company and its finance company are going to collaborate. A good example of this is the recently launched ‘VWFS Drive’ product that provides lease and contract hire sales using Volkswagen Group stock.

Now that the OEM sets price, it means that it is the OEM that determines discount levels to allow it to compete in the market. It may not have it at the start, but it will build a data set for consumer demand, and in what geographical areas, at what time of day / month / year and so on.

Add in the ‘connected car’ and it is easy to see how much information will be available to OEMs and retailers in future. It means the automotive sector will be able to personalise offers and information in the same way that we see from the best ecommerce businesses.

It also has the potential to help how production is planned and its impact and how cars are moved around global markets.

To summarise, the OEM will use different levers because they can no longer simply push , with cash attached, into the network using the Field Teams to encourage sales.

Part Exchange

Control over the part exchange price and who buys it will have to change. The price will be set as part of the quotation step and it is will be an online tool that is used. Then there is a choice whether the retailer or the manufacturer buys the car. Models may be different, and it will affect the sales process for the retailer.

Online

We have seen lots of new online solutions appear during lockdown, but few are seamless omni-channel sales processes. Nor are they ‘trading platforms’ yet, as you would find at Amazon and Argos, where the OEM can pull different levers based on daily supply, demand and sales data.

Add in what the UK’s retailers have achieved over the period, there is now a plethora of deployed systems which will need to be tied up as we head into 2021.

NSC Functions

The Customer Relationship Management (CRM) task for the OEM increases dramatically. For new cars sales, the OEM takes on responsibility for thousands of retail consumers. As described above, the tools allow for the ongoing and personalised conversation with customers. The data topic has to be overcome and CRM teams will have to grow, but none of this is insurmountable.

The role of Marketing in the OEM also changes. For new cars, they push leads towards the ecommerce platform rather than retailers. That also means that the OEM need to have the capability to speak to customers during their sales journey. And obviously, because we are talking about an omni-channel process, it means seamlessly over email, phone, chat, text, WhatsApp, and at the store.

It also means that the marketing effort and its link to sales can be more closely and accurately measured.

Currently, most day-to-day queries and complaints are resolved by the retailers. A proportion of these are escalated, which, along with the direct queries, go to the OEM and their sizeable customer service operations. It remains to seen, how the entirety of customer contact is distributed in future, but it will have to be planned.

Culture

But the biggest challenge of all will be the change in culture to accompany the practical changes. The fundamentals of vehicle wholesale and the relationship with the retailer has not really changed over the last 35 years. The shift described above significantly changes the role for both.

What it Means for the Retailer:

Advocacy

The retailer remains a fundamental part of the omni-channel new car sales process. Roles include (and not limited to):

- The ‘bricks’ in ‘bricks and clicks’.

- Local brand advocacy.

- Local marketing and events.

- Static demonstration and test drives.

- PDI and handover.

The OEMs pay fees for these services. There may be targets too, but it provides predictable revenue based on volume through the retailer. Traditionally, add on products such as Gap Insurance and paint treatments have been used to bolster margin. It remains to be seen how these are treated in future.

The customer will choose the retailer during the sales process. It will be whatever suits them, for example, a location near work or near home. The price will be set by the OEM, as we have said. Either way, the retailers still have an opportunity to attract custom through the experience they deliver.

Product Expertise

As we move increasingly into the electric era, the choice for customers has multiplied. Therefore, while negotiation of the new car price goes, the need for product specialists has increased. Again, this concept is not new and is deployed in John Lewis, Apple and some of the Shopping Mall concepts in our industry.

This is a cultural shift because the retailer no longer ‘deals’ on new cars, and their teams will be focussed on brand advocacy and product demonstration. This will affect how retailer teams are organised and their remuneration policies.

Online Choices

Through the pandemic, retailers have been very innovative and have delivered several new processes very quickly. Home delivery, click and collect, online sales processes, video calls and so on were implemented during the first lockdown and were able to be redeployed for the second one. And when you add the OEM platforms, you can see there is a task to make sure this all works together for the customer.

Bricks

There are also property implications as new retail formats (described above) become more common. OEMs having taken on some of the consumer responsibilities, may choose to change the brand stands for their outlets, possibly becoming more prescriptive, in return for smaller display space.

The interface with the OEM will evolve too, under the new sales process. Field teams will have different roles.

Summary

This article attempts to show the high-level impacts of an omni-channel direct sales model. Implemented well, the outcome will improve the customer experience and choice across all channels. It makes the OEM’s sales process more efficient and predictable. It should shore up network margins and reduce their working capital – do not forget, pre-Covid-19 2019 saw the sector at 0.81% return on sale.

The transition to this model is tough but possible. It is probable that OEMs will have to ‘dual run’ agency and margin models at the start, for example, using BEVs as some OEMs have done already. This will require careful planning and management. There will also be the change management challenge across the entire customer journey.

But we have moved from possible to inevitable if you have read the latest contributions from McKinsey and Cap Gemini.

Credit to Stuart Copeland for the article (written with input from Atonic4 Founders), which was first published in the December 2020 edition of www.auto-retail.co.uk